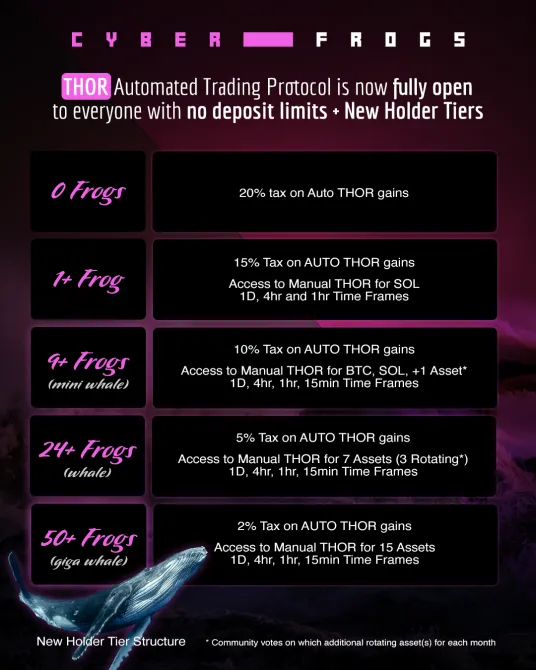

Different Thor Tiers

As seen in this image, different levels of ownership offer different access to Thor. Please keep this in mind when you start to use Thor.

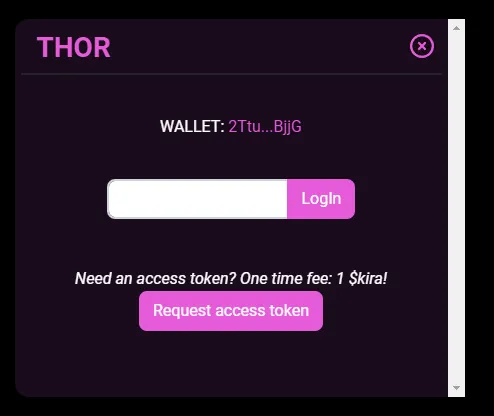

Getting Started with Thor

Step 1: Go to https://cyberfrogs.io/thor

Step 2: Request Access Token (copy and paste) and Login

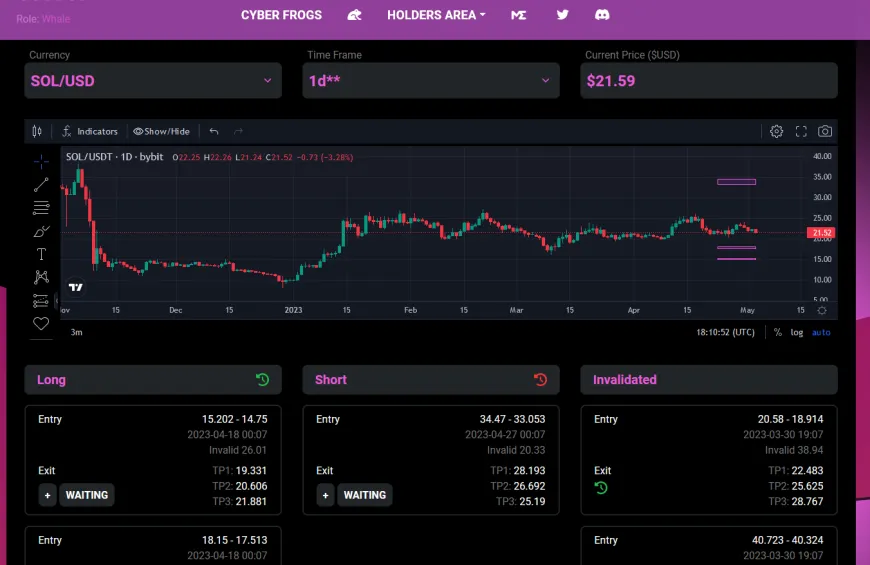

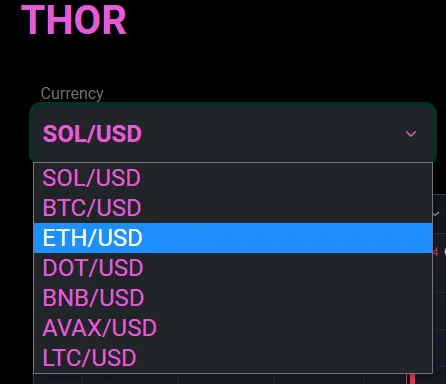

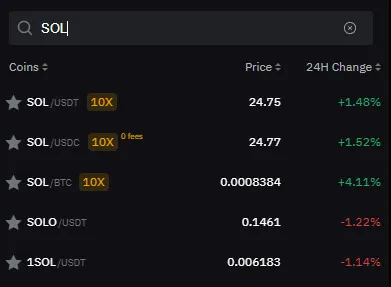

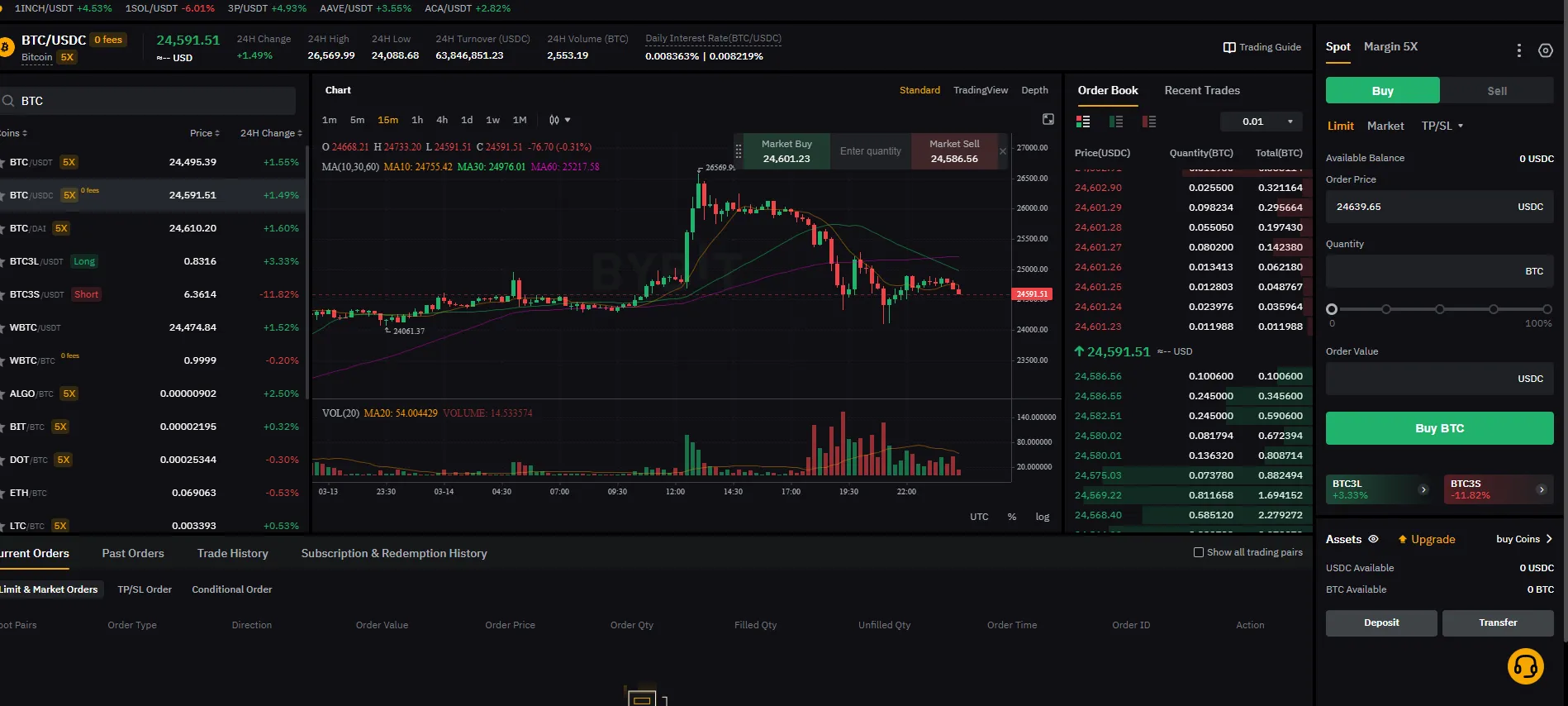

Step 3: Check currency pairs to trade

Select Trading Pair

Factors that you can consider to help you make a decision on selecting a trading pair

Market Capitalization: The market capitalization of a cryptocurrency represents the total value of all the coins in circulation. Generally, cryptocurrencies with higher market capitalization have more liquidity and lower volatility, making them less risky to trade. Bitcoin, Ethereum, and Binance Coin are some of the most popular cryptocurrencies with high market capitalization.

Trading Volume: The trading volume of a cryptocurrency represents the total amount of coins traded over a specific period of time. Cryptocurrencies with high trading volume are more likely to have tighter bid-ask spreads, meaning that traders can buy and sell the coins at a better price. High trading volume also ensures that the market is more liquid, meaning that traders can enter and exit their positions quickly. Bitcoin and Ethereum typically have high trading volume compared to other cryptocurrencies.

Volatility: Volatility is a measure of how much the price of a cryptocurrency fluctuates over time. High volatility can provide traders with opportunities for high profits, but it also means that there is a higher risk of losses. Cryptocurrencies like Solana and Cardano are known for their high volatility.

News and Events: Cryptocurrency prices can be influenced by news and events such as regulatory announcements, partnerships, and product launches. It is important to stay up to date with the latest news and developments in the crypto industry to identify potential trading opportunities.

Technical Analysis: Technical analysis involves analyzing price charts and using various indicators to identify potential trading opportunities. Traders can use various tools such as moving averages, trendlines, and support and resistance levels to identify potential entry and exit points.

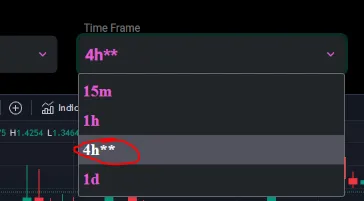

Step 4: Check multiple Time Frames

What do the ** mean?

The two asterisk ** indicate an active or waiting calls in that timeframe.

Which time frame to select? 15m — 1D

15-minute (15m) charts: This timeframe shows price movements over 15-minute intervals. This is a short-term timeframe that is commonly used by day traders who are looking to take advantage of small price movements during the day. These traders typically use technical analysis to identify short-term trends and patterns.

1-hour (1h) charts: This timeframe shows price movements over one-hour intervals. It is commonly used by traders who are looking to capture short-term trends that last for a few hours.

4-hour (4h) charts: This timeframe shows price movements over four-hour intervals. It is commonly used by swing traders who are looking to capture trends that last for a few days.

Daily (1D) charts: This timeframe shows price movements over one-day intervals. It is commonly used by long-term traders who are looking to capture trends that last for weeks, months, or even years. Daily charts give a broader view of the market and are useful for identifying long-term trends.

Each timeframe has its own advantages and disadvantages. Shorter timeframes give a more detailed view of the market but can be more volatile and subject to market noise. Longer timeframes give a broader view of the market but can be slower-moving and may require more patience. It’s important to choose a timeframe that suits your individual trading style and goals.

Note the different timeframes sometimes conflict in terms of long or short signal. Depending on your strategy, many traders will seek alignment on the different time frames or hedge the longer time frame positions with shorter time frames for more experienced traders.

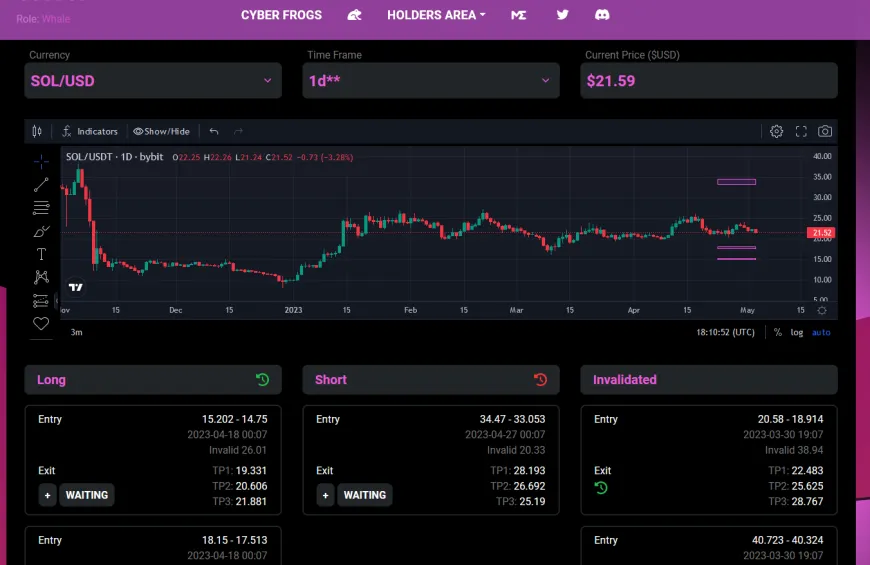

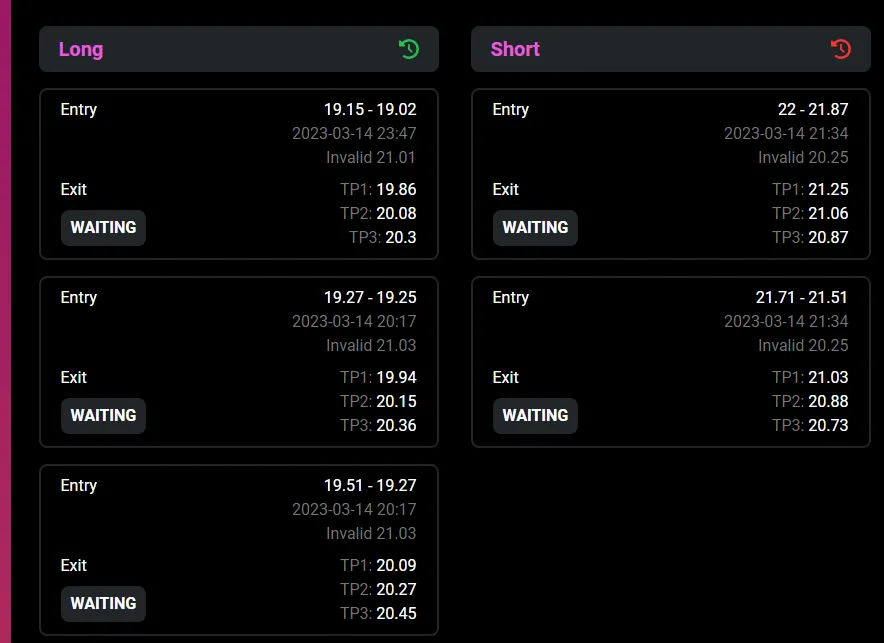

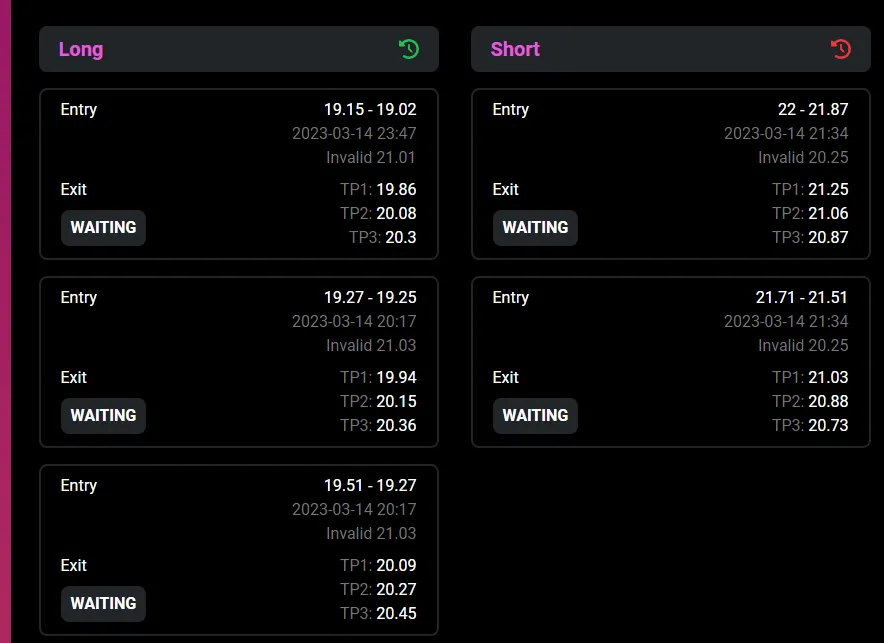

Step 5: Check pulldown menu for Long or Short trade calls

Long Positions (BUY)

Long position means you’re betting that the price of the futures contract will go up. For example, let’s say you believe that the price of BTC is going to go up in the future. You can take a long position on a BTC perp contract, which means you’ll buy the contract at the current price and hope to sell it at a higher price in the future. If the price does go up, you’ll make a profit on the difference.

Short Positions (SELL)

Short position means you’re betting that the price of the perpetual contract will go down. For example, if you think the price of BTC is going to go down, you can take a short position on a BTC futures contract. This means you’ll sell the contract at the current price and hope to buy it back at a lower price in the future. If the price does go down, you’ll make a profit on the difference.

Both long and short positions come with risk. If the price of the futures contract doesn’t move in the direction you anticipated, you could end up losing money. That’s why it’s important to do your research and make informed decisions before taking a position.

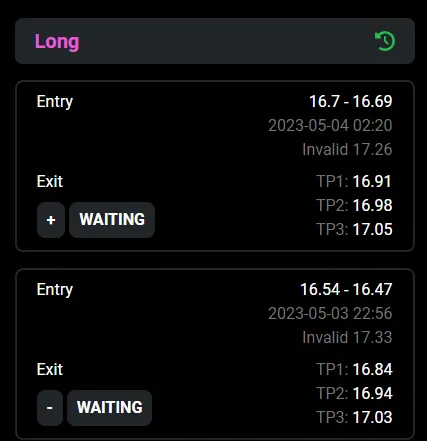

** HOW TO CREATE WATCH LIST **

1. Click “+” symbol to add to watch list and click “-” to remove call from watch list

Then to see created list click watchlist button

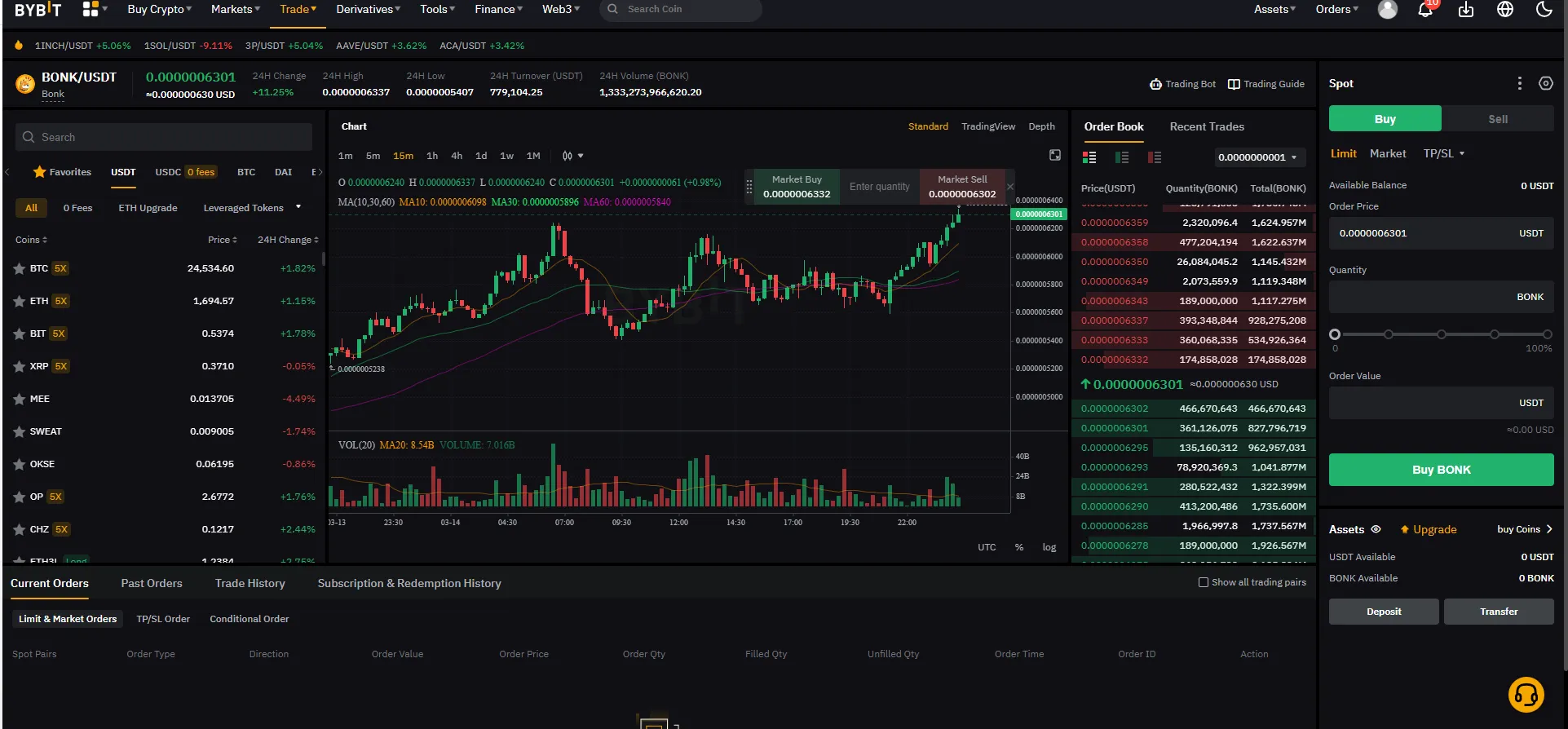

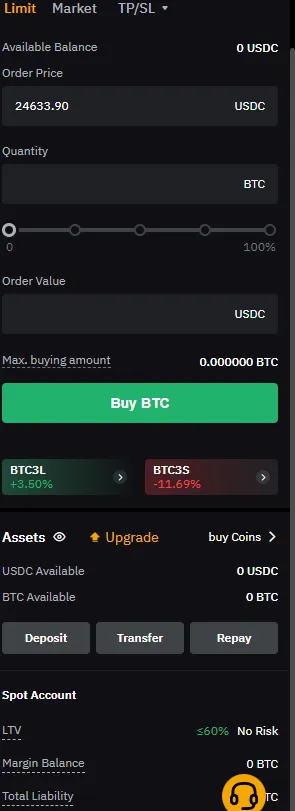

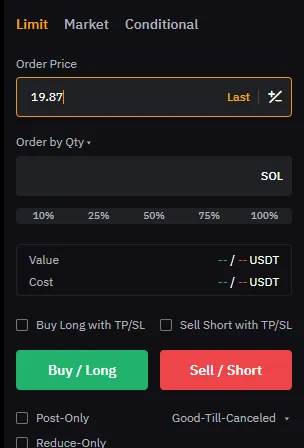

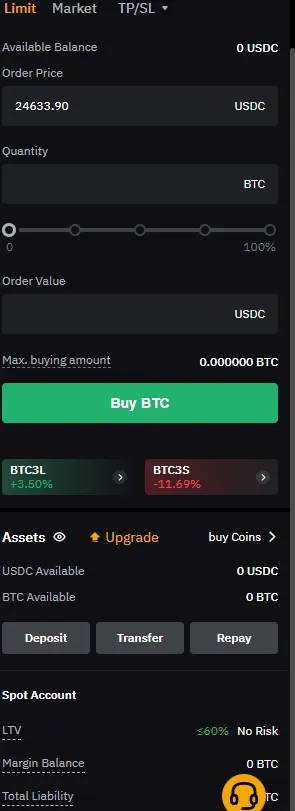

Step 6: Go to preferred trading platform (ex. Binance, ByBit)

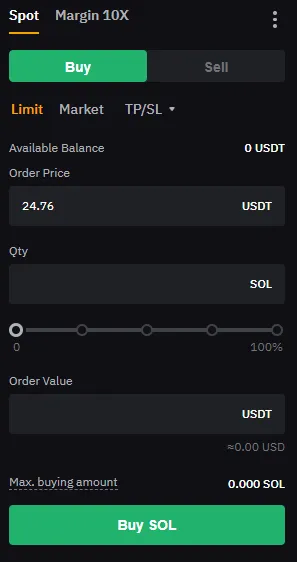

(image above using ByBit trading platform)

Step 7: Type selection of trading pair (ex. $SOLUSDC or $SOLUSDT)

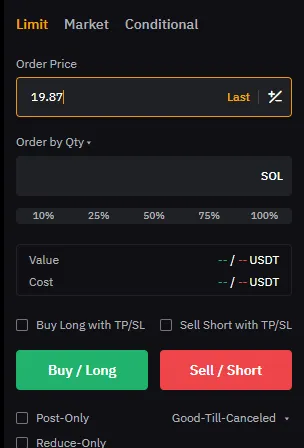

Step 8: Select Long or Short Position from Thor

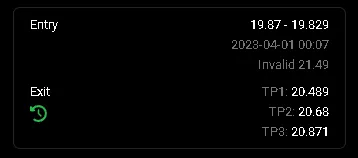

Entry Prices and Take profits are indicated on the map when you press “show/hide” tab

Select Buy or Sell on right side of screen on trading platform

Selecting Limit or Market price

When you want to buy a cryptocurrency, there are two main types of orders you can place: a Limit Buy and a Market Buy.

Limit Buy: This is an order to buy a cryptocurrency at a specific price or lower. For example, if the current price of Bitcoin is $50,000, and you want to buy it if the price drops to $45,000, you can place a Limit Buy order at $45,000. If the price drops to $45,000, your order will be executed and you will buy Bitcoin at that price or lower.

Market Buy: This is an order to buy a cryptocurrency at the best available price in the market. For example, if the current price of Bitcoin is $50,000, and you want to buy it right away, you can place a Market Buy order. Your order will be executed at the current market price, which may be slightly higher or lower than the price you saw when you placed the order, depending on the market conditions.

A Limit Buy order allows you to specify the maximum price you are willing to pay for a cryptocurrency, while a Market Buy order allows you to buy a cryptocurrency at the current market price. Each type of order has its own advantages and disadvantages, depending on your trading strategy and market conditions. It’s important to understand these differences and choose the order type that best suits your needs.

Step 9: Input Entry price from Thor to Order price on trading platform

Step 10: Input amount of available currency willing to trade

Amount can be chosen by percentage of trading account holdings (10% 25% 50% 75% 100% etc.)

Step 11: Click Buy/Sell

Congrats! Now you’ve completed your first trade. Follow our medium page for future trading resources!

Disclaimer:

The following disclaimer applies to the use of our Thor Automated protocol tool:

Thor Automated protocol or also known as TAP is intended to provide users with insights and analysis to make informed trading decisions. However, the use of our trading tool does not guarantee profits or prevent losses in trading. The tool’s performance may vary based on market conditions, and historical performance may not be indicative of future results. It is the user’s responsibility to make their own decisions and conduct their own research before making any trades. We do not take responsibility for any losses or damages resulting from the use of our trading tool.

**RISKS OF TRADING**

Trading, whether it be stocks, commodities, or cryptocurrencies, comes with inherent risks. The biggest risk is the possibility of losing money. When you buy an asset, there’s always a chance that the value of that asset could decrease, causing you to lose money if you sell it. Additionally, trading can be volatile, meaning that the value of an asset can fluctuate rapidly and unpredictably. This can make it difficult to make informed decisions and can lead to unexpected losses. Another risk of trading is that it can be influenced by factors outside of your control, such as global events, government policies, or changes in market sentiment. These factors can cause sudden changes in asset values and can lead to losses. Finally, there’s the risk of making mistakes or being scammed. If you’re not careful, you could accidentally make a bad trade or fall victim to a fraudulent scheme. It’s important to do your research and be vigilant when trading to avoid these risks. Overall, trading can be a potentially profitable but risky endeavor. It’s important to understand and manage these risks to minimize losses and maximize gains. This includes developing a solid trading strategy, doing your research, and being disciplined with your investments.